Researching a Student Debt Issue

This project incorporates the internet of things principle of having physical objects interact digitally to help solve a problem.

The goal for this project is to prototype a product or system that helps millennial women with college degrees curb impulse buys in order to focus on using that money to pay back student loans. Women are not only shouldering more of the national student debt, but also are more likely to make impulse purchases.

Student Debt

The prevalance of student debt in the US is $1.56 Trillion, which is equivalent to 31,200,000 pairs of jeans or 1,952,440 iPhones. The debt has tripled since 2005.

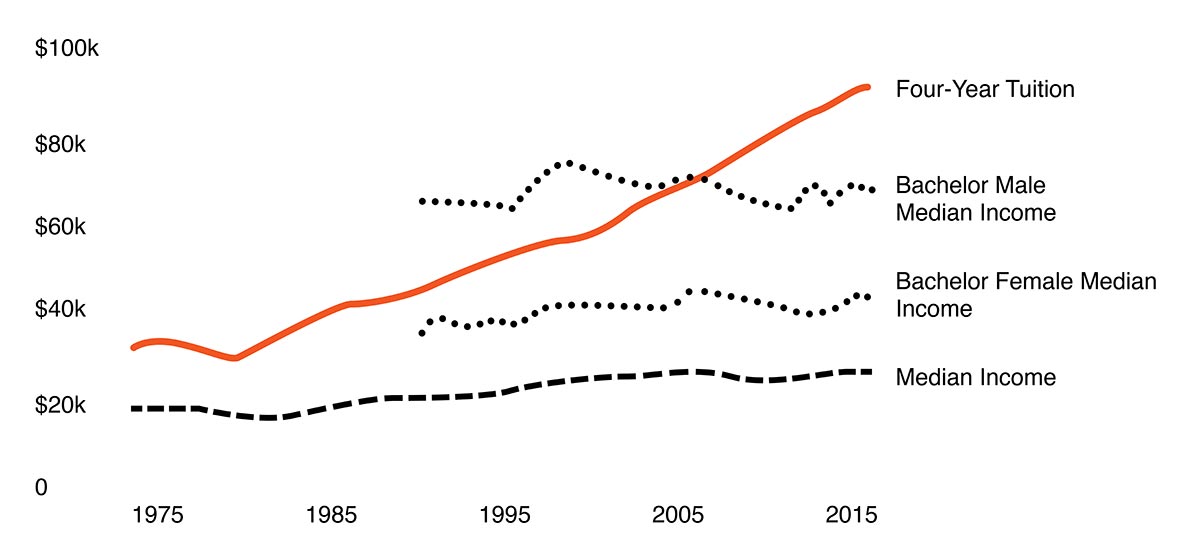

Tutition for college has increased at a faster rate than the level of income for students with degrees. This is exaserbated for women, who typically earn a lower salary than males with an equivalent amount of schooling.

Specifically for millennials in Texas, student loan debt is the largest share of millennial debt, accounting for an average of 40% of their total credit and loan balances. Millennials in Texas ranked #1 and #3 with the highest amount for the age group.

The average student debt in San Antonio is $27,122, while Austin is $26,164.

College Borrowers

65% of students borrow money to pay for college and 65% of of those borrowers have under $1000 in savings after graduation—before they need to start paying back their student loans.

56% of college students are women and they on average borrow $2700 more than men. Women shoulder $890 Billion of the total student debt. Most students who take out high-interest loans are borrowing more than they need to live. Students are not aware that they do not have to accept a loan for the offered amount and can take a smaller loan.

Impulse Purchases

Chase Bank found that 83% of US millennials had made an impulse purchase. This was especially likely on payday or when millennials were cruising shopping websites online. In those instances, their urge to purchase items on impulse alone exceeded that of other age groups.

42% of US millennials had made an impulse purchase in the past four weeks.

Men buy electronics. Women buy clothing.

Chase indicated that millennials were more likely to express regret or dissatisfaction after an impulse purchase. Women are also more likely to make impulse purchases, with 20% of female shoppers citing “retail therapy” as reason for buying, but only 9% of males.

With every 1% increase in student loan debt, the likelihood of owning a house decreases by 15%. Students with loans are also 11% less likely to start a business. For a consumer-driven economy like ours, less spending means lower revenues and profits, slowing financial growth of the city.

Applying Research

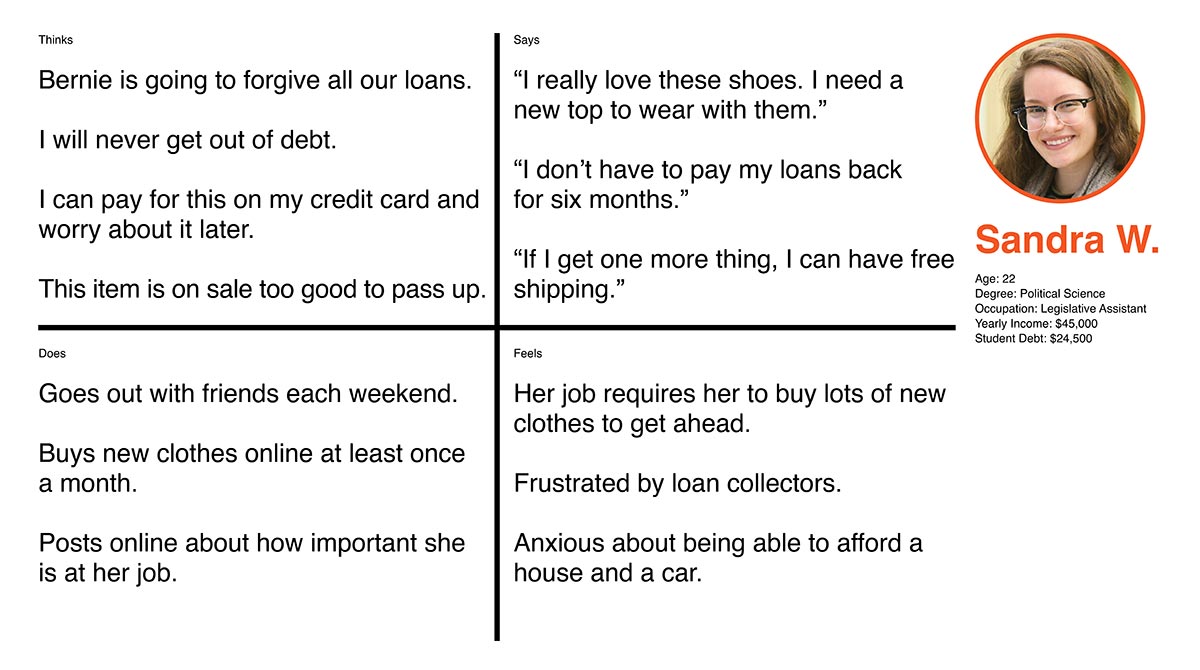

To focus on a target demographic, an empathy map was constructed to give a face to the user.

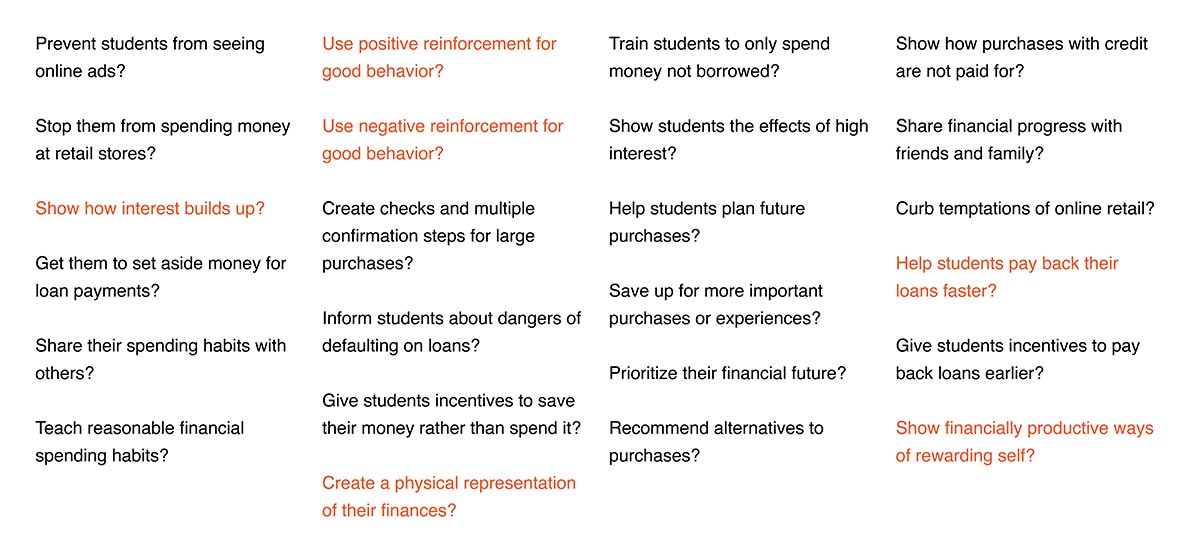

To brainstorm ways to help users understand the issues surrounding their impulse buying and the weight of the debt they carry, How Might Wes (HMWs) were listed and prioritized. These become possible features for the final prototype. The list was generated based on social and psychological principles of spending habits found in young adults.

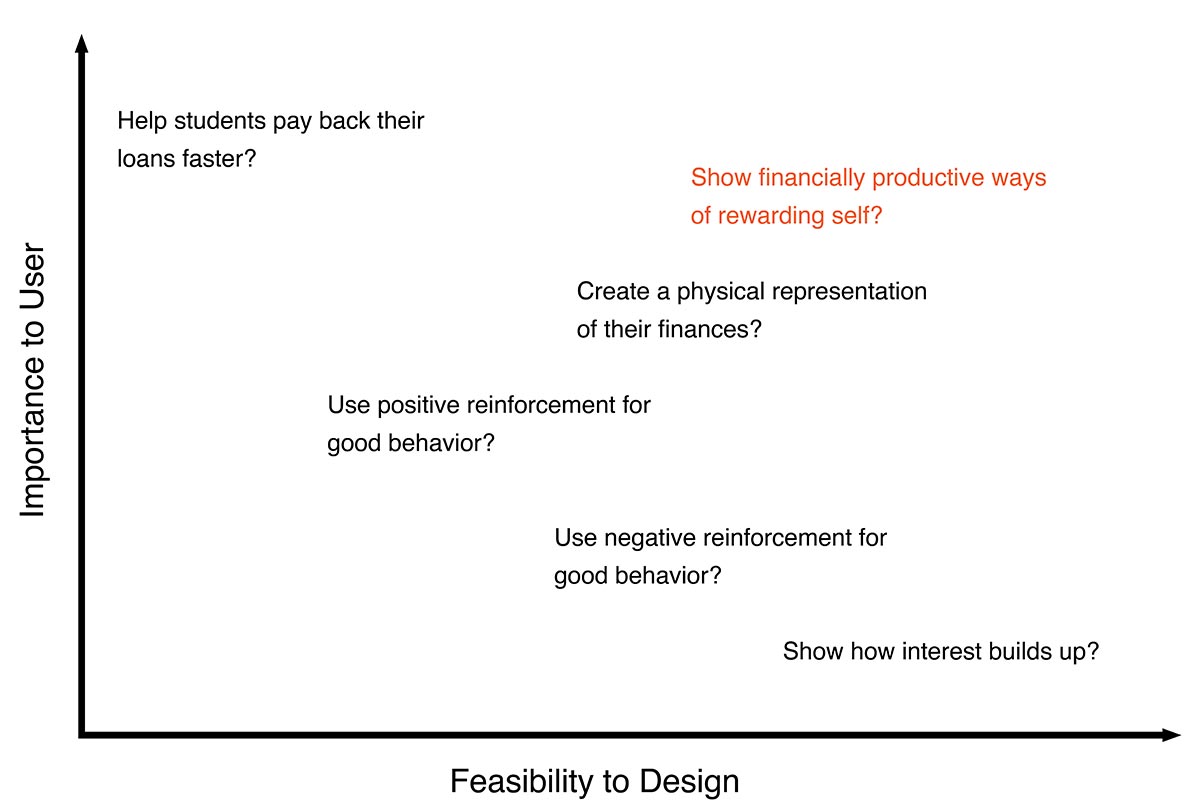

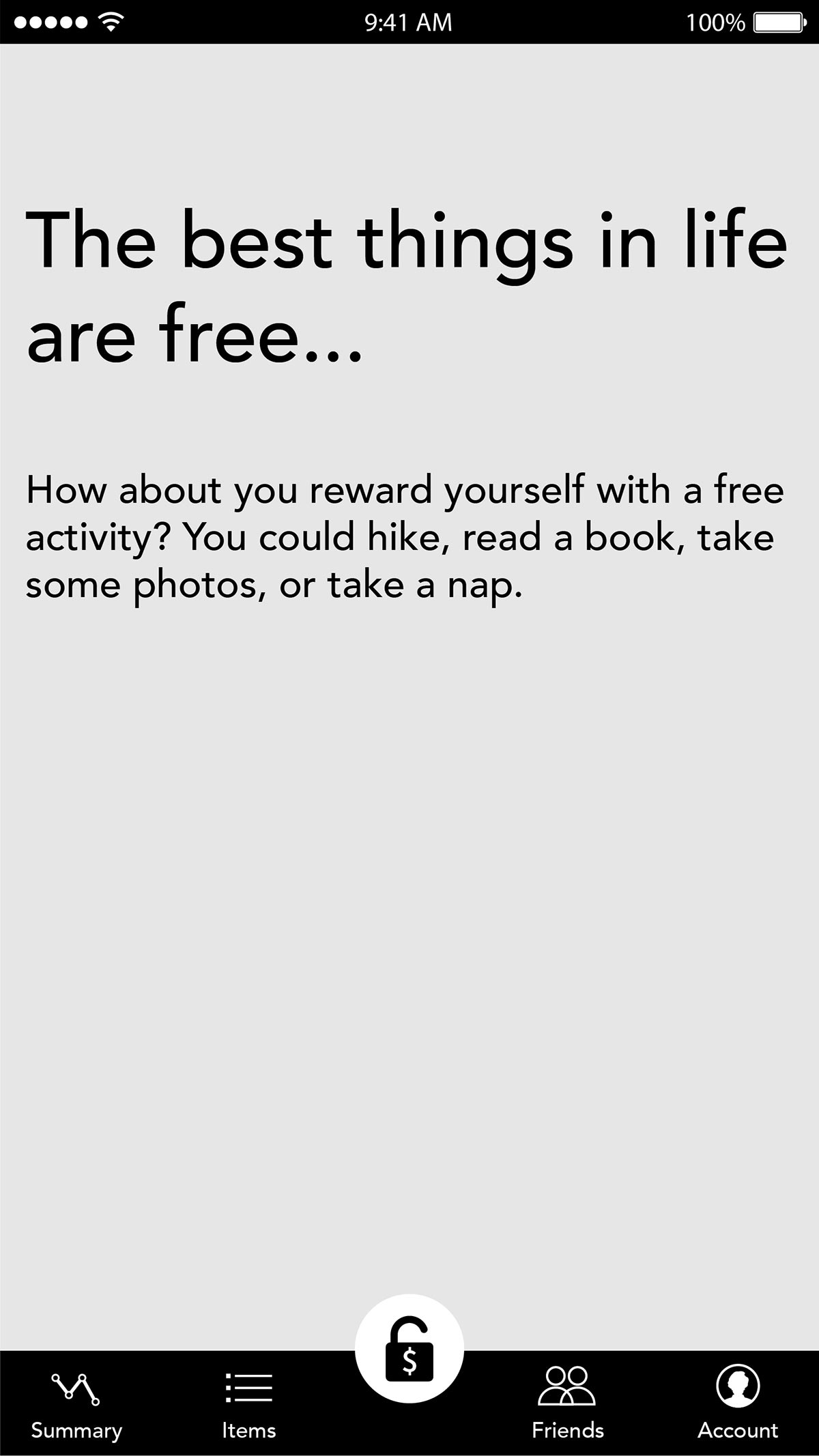

The prioritization grid for the voted on HMWs indicates that showing students how to reward themselves without spending money is both important to the user and fairly easy to design.

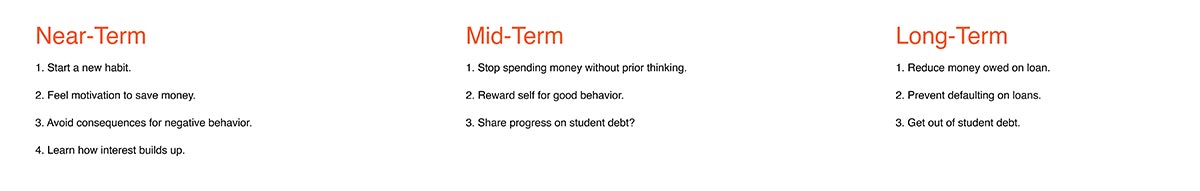

This lead to the creation of an experience roadmap where we take our users through a certain feature set over time. Our user can / Our user will be able to…

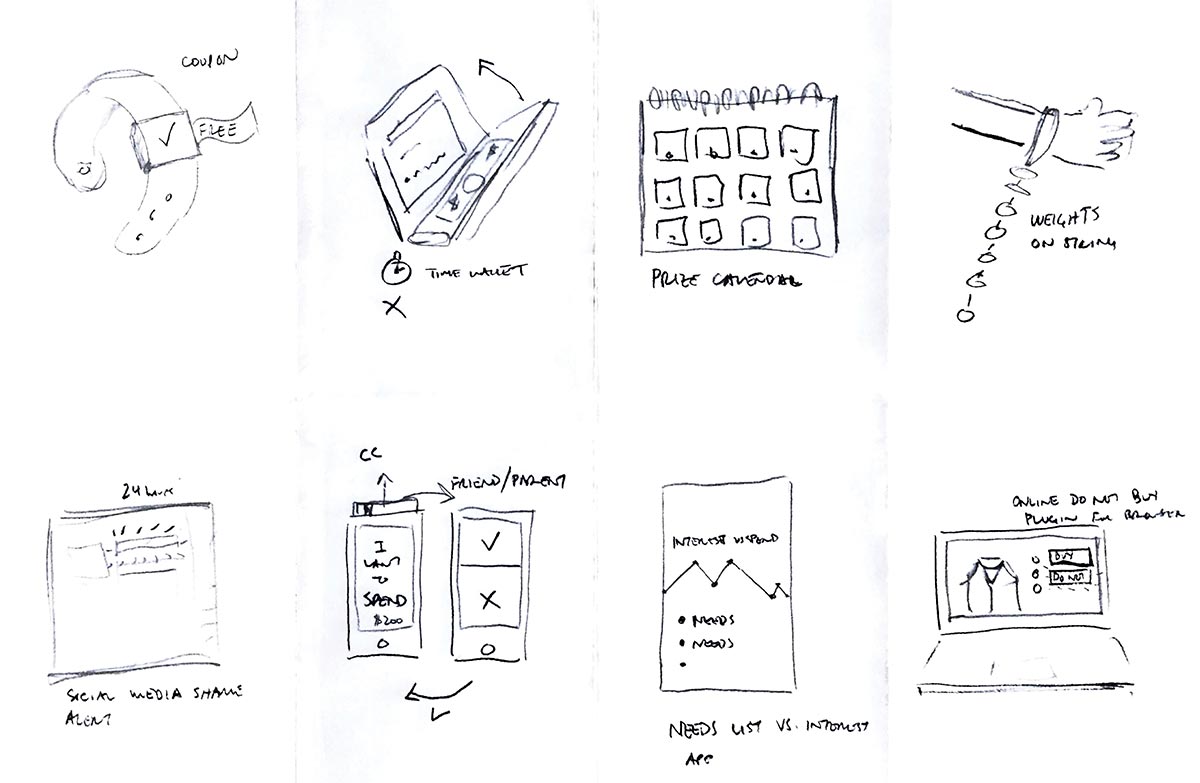

Sketeches were made of various potential products that meet the requirements of the research.

Solution

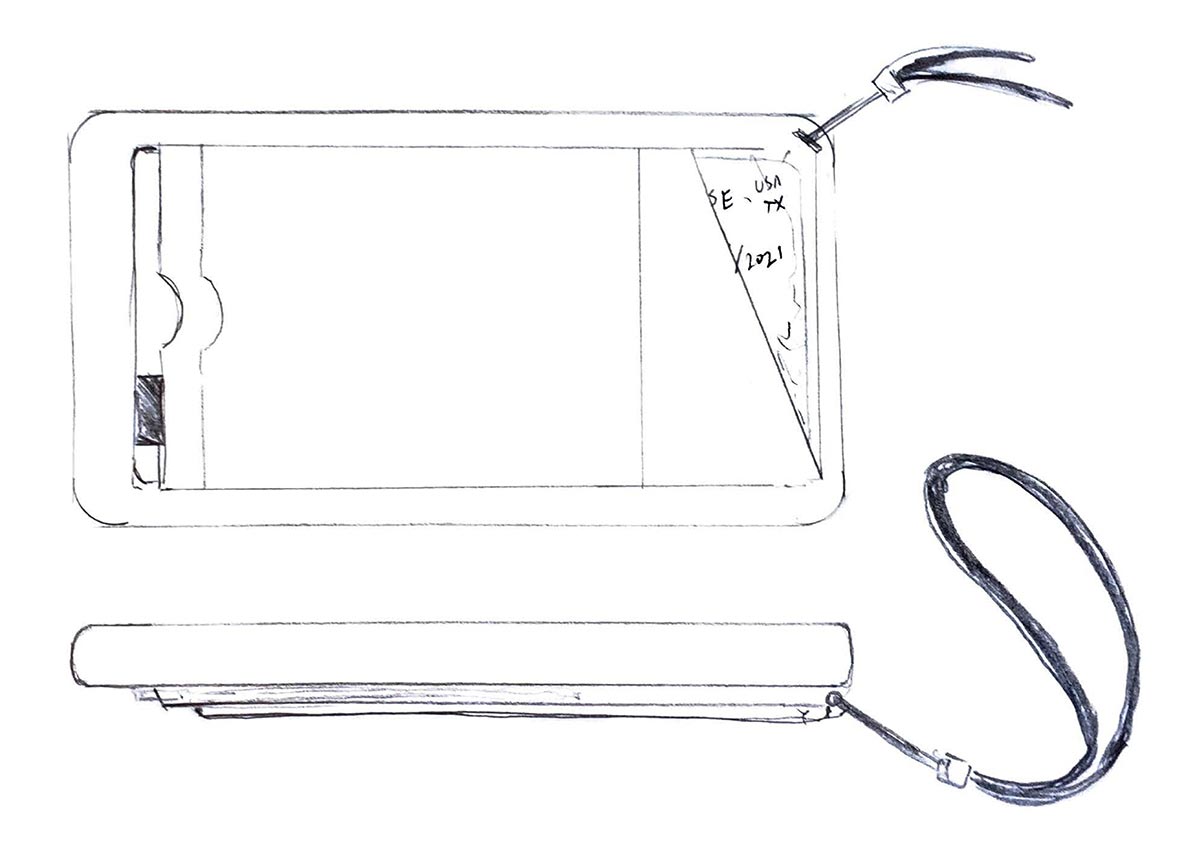

After sketching, the best solution became a phone case with a companion application, since it would be easy to integrate into a college student’s existing lifestyle.

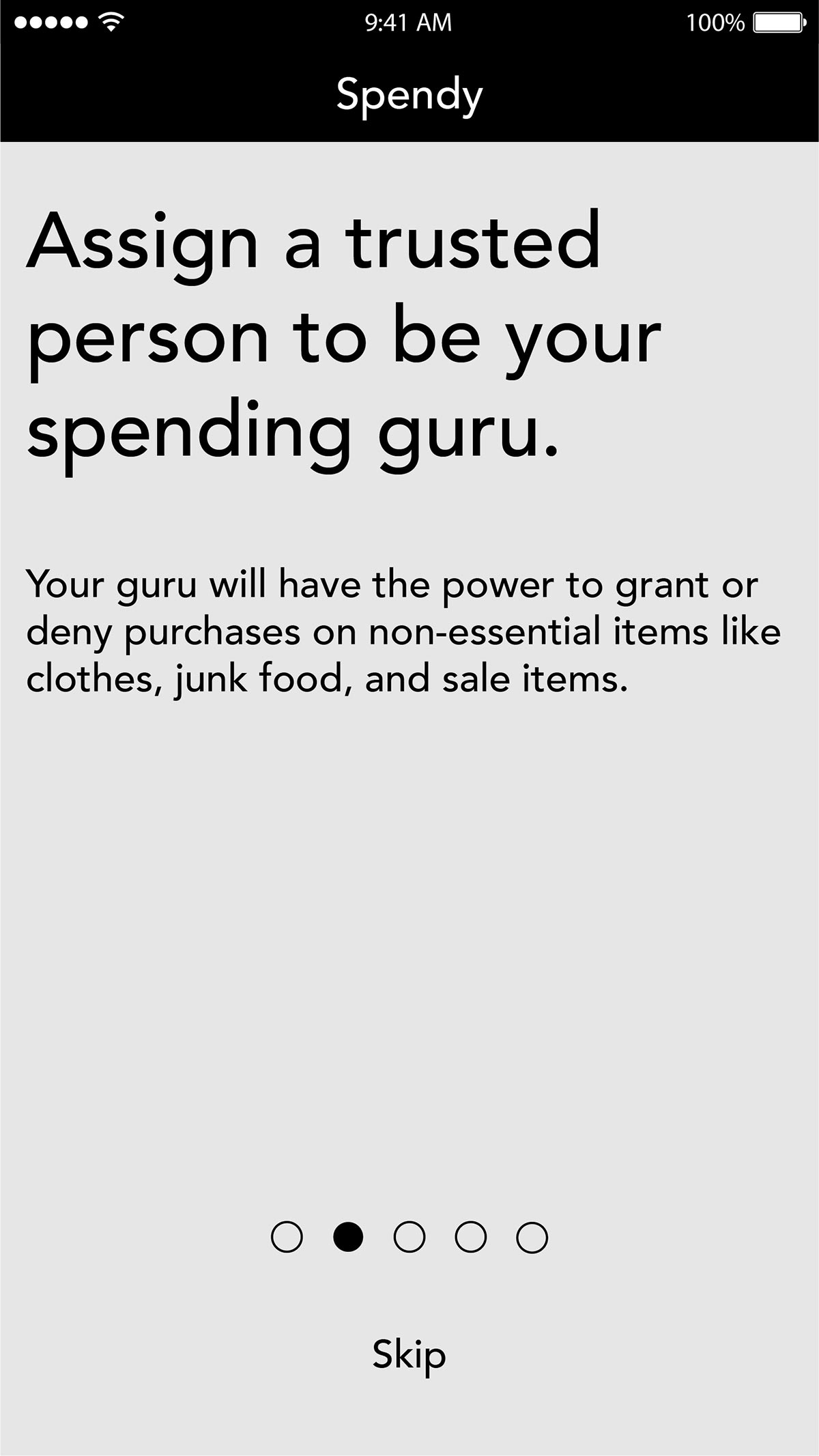

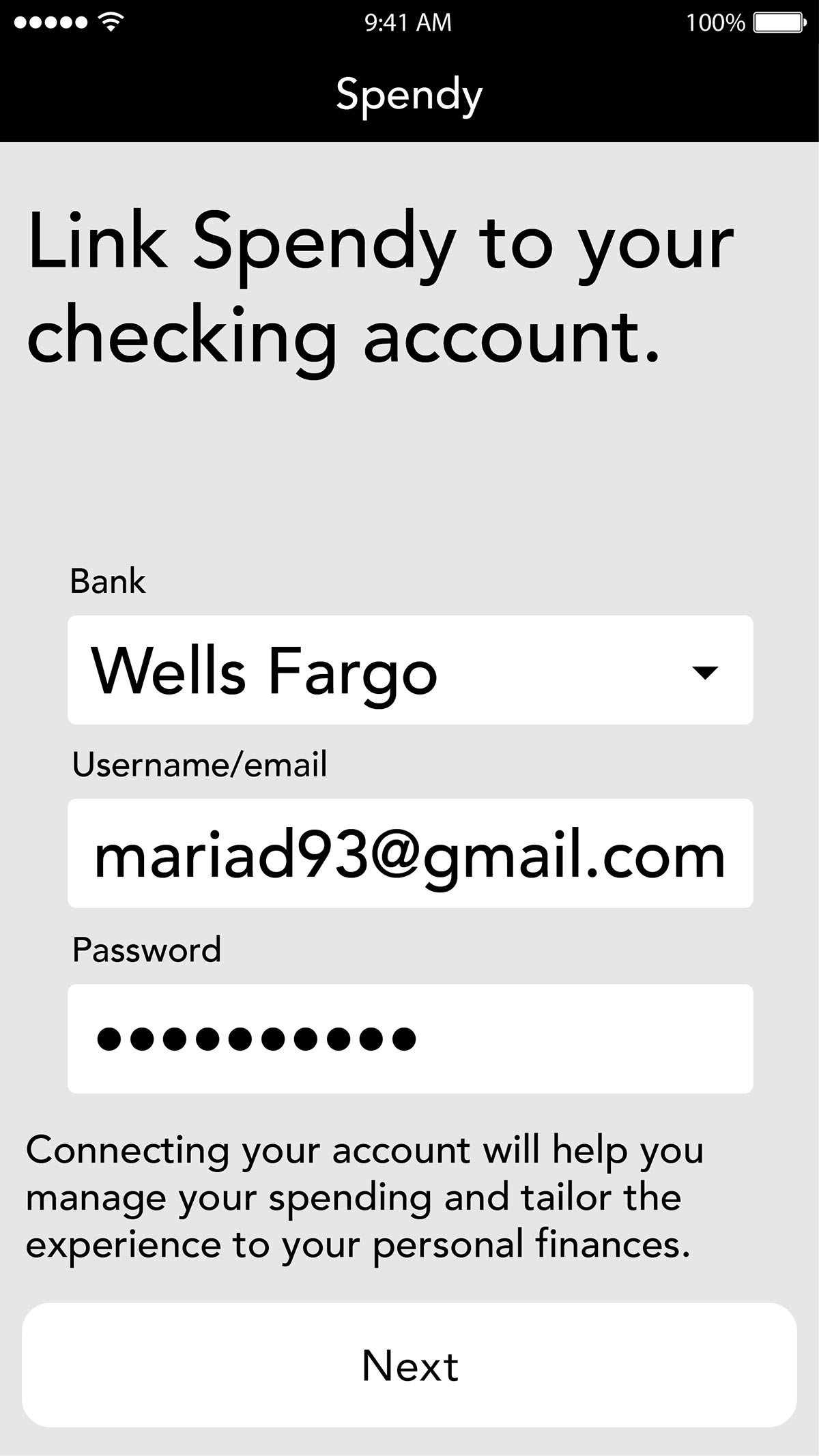

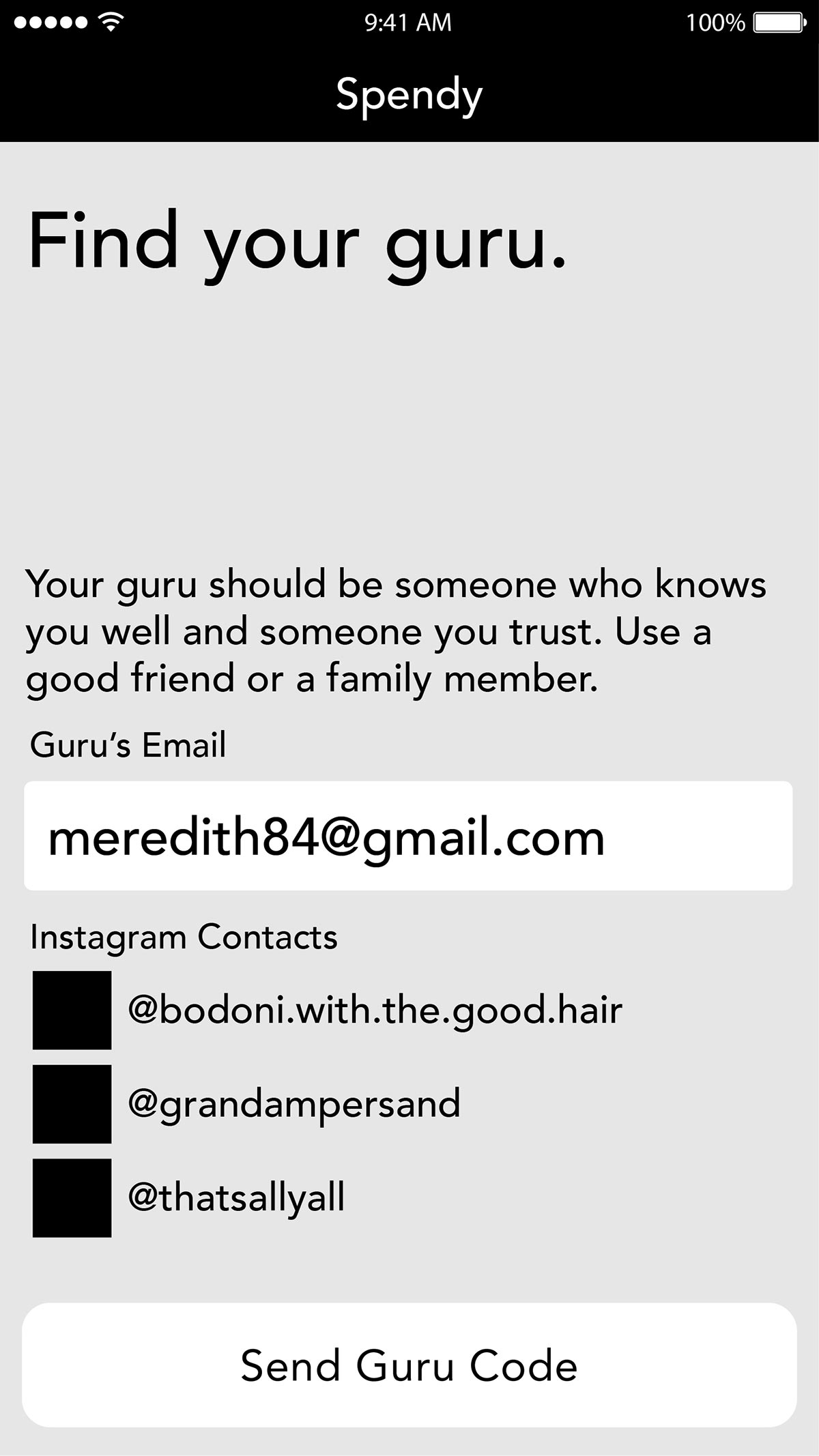

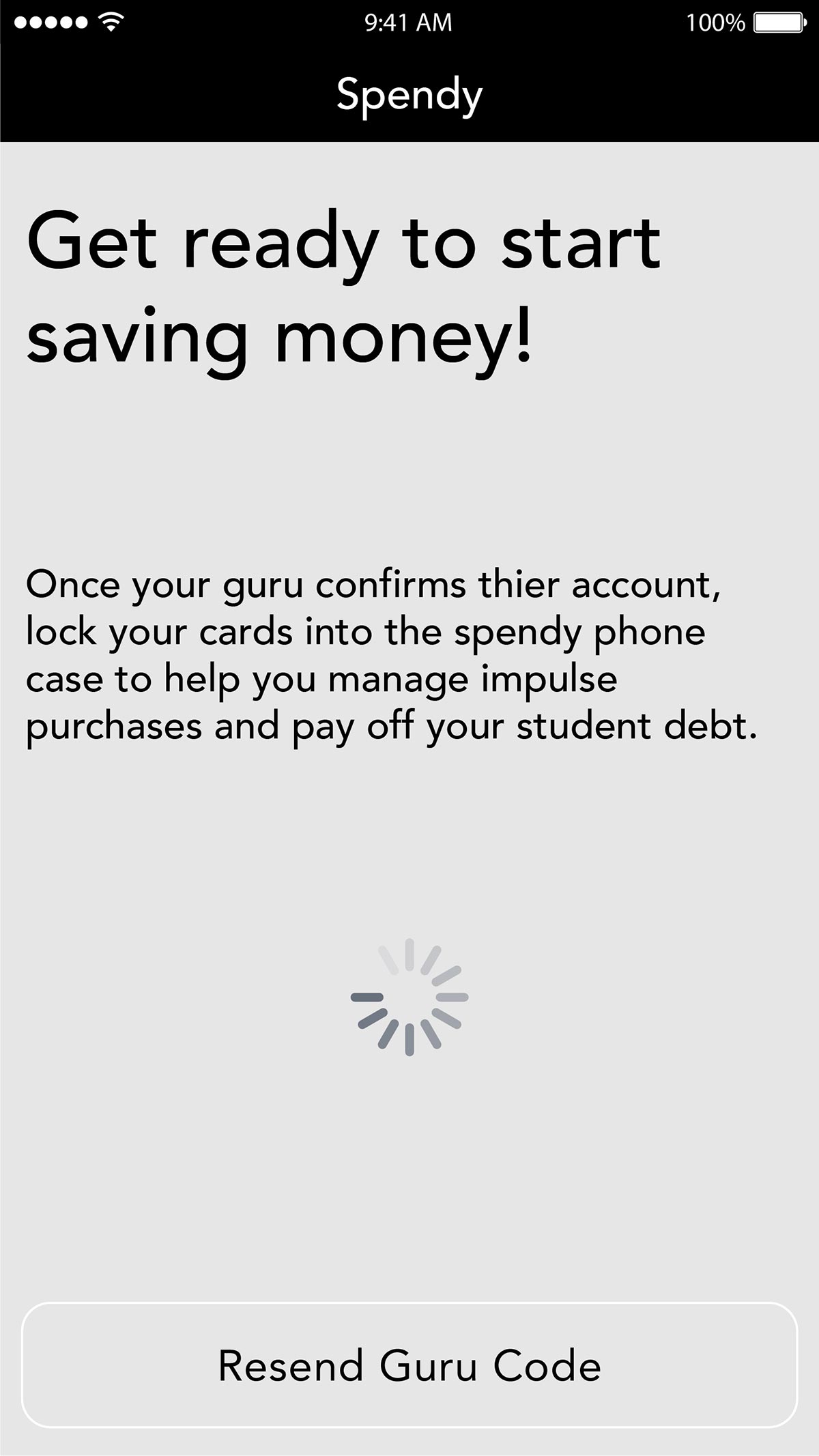

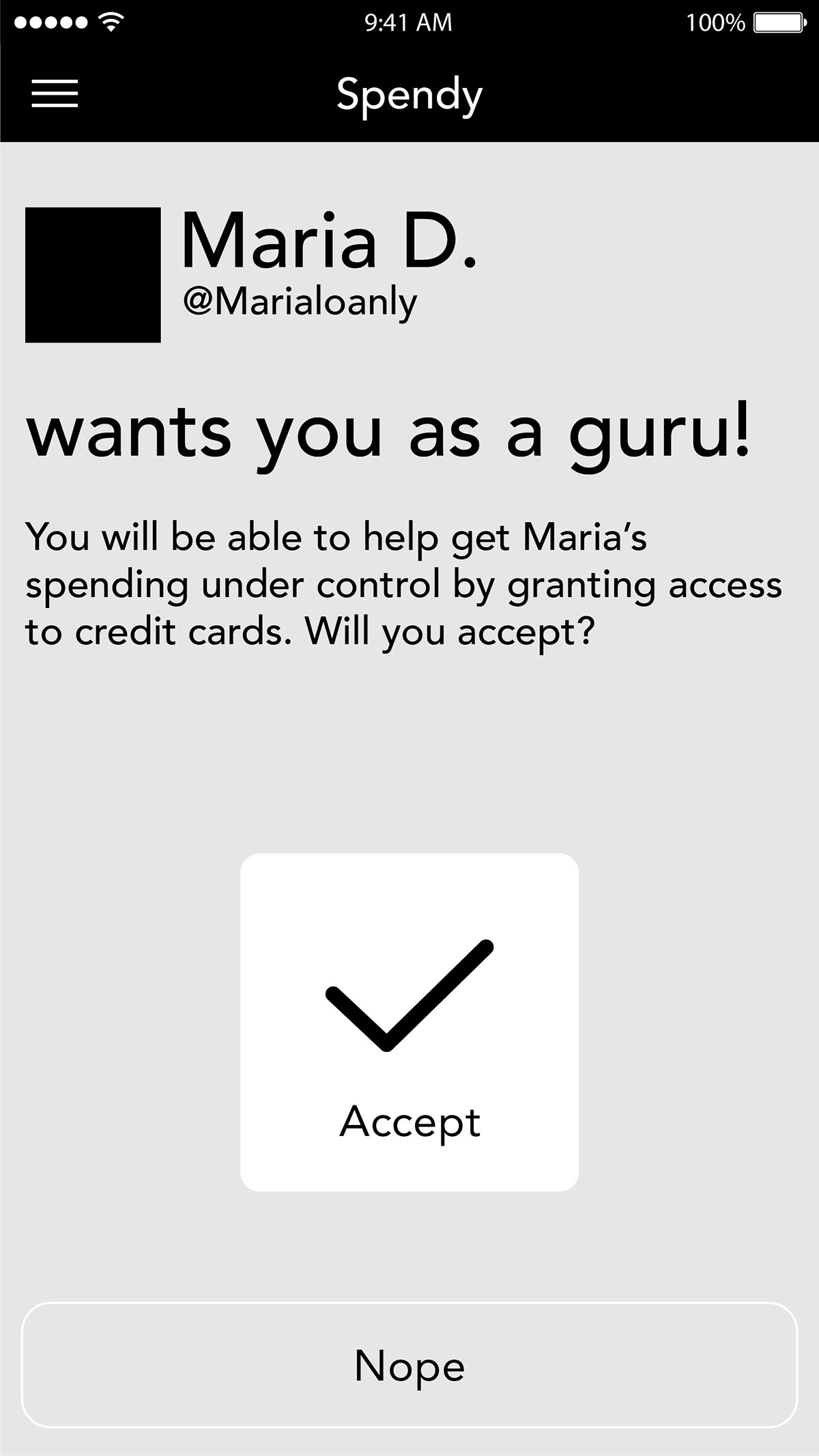

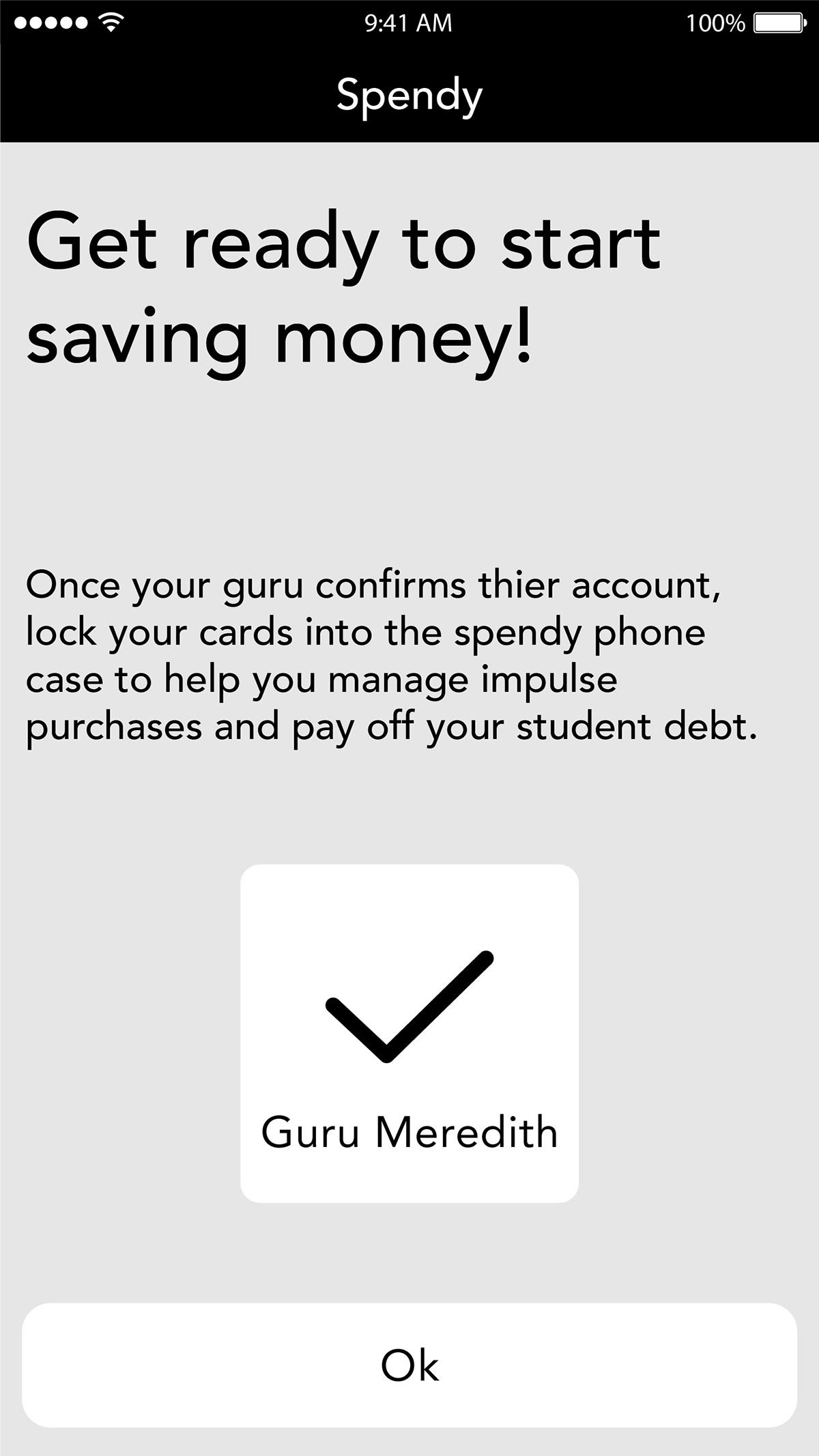

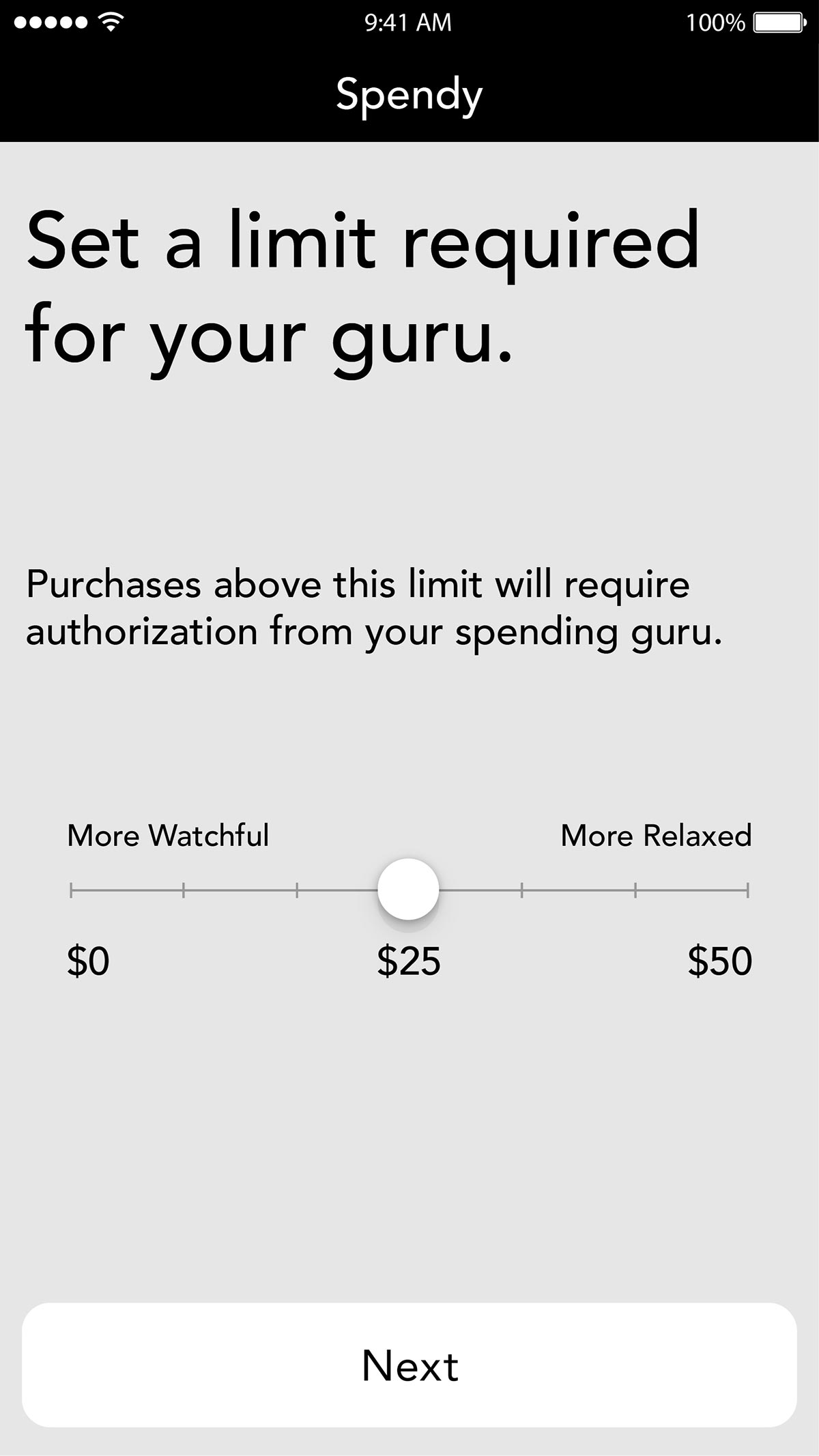

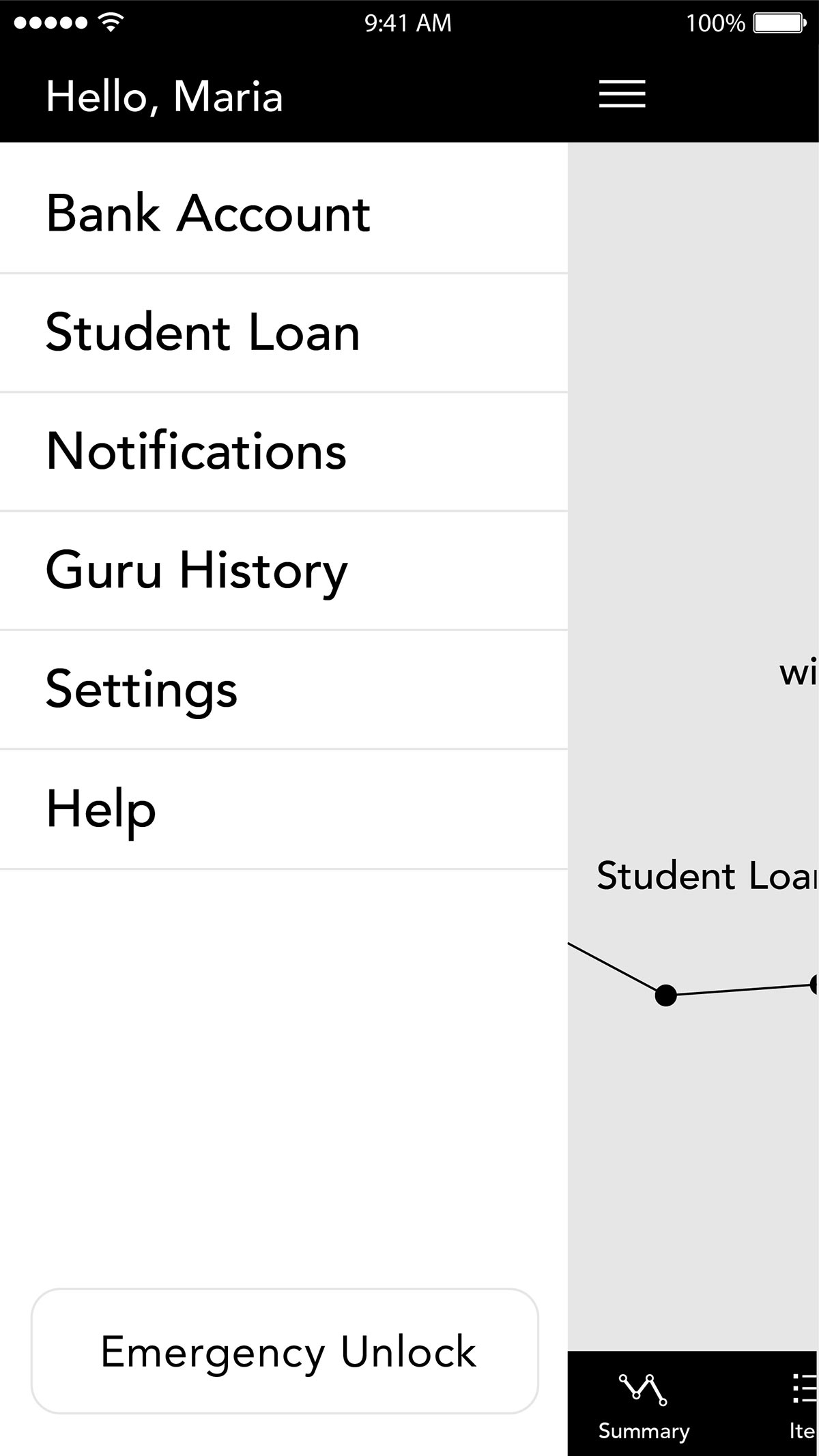

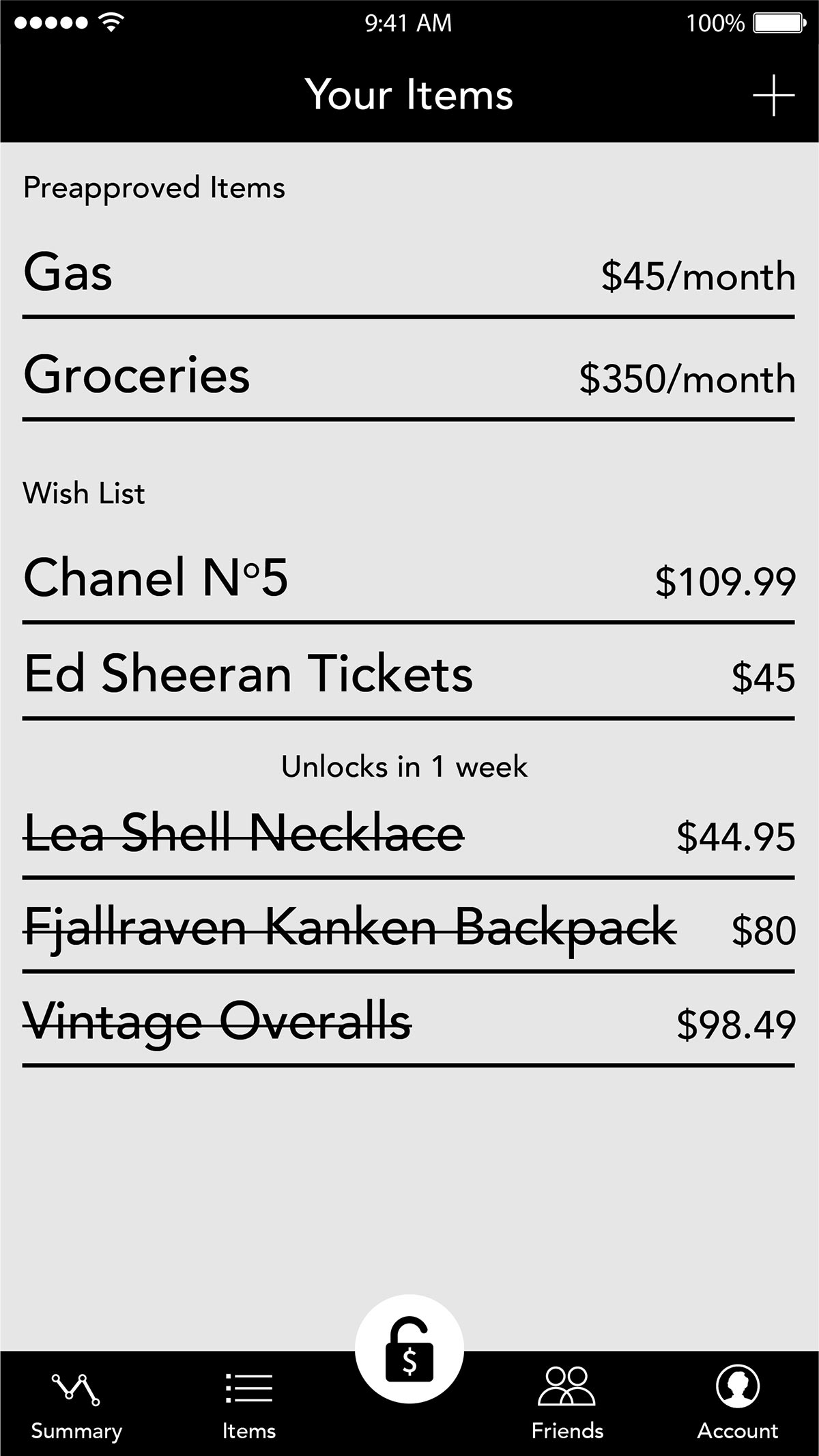

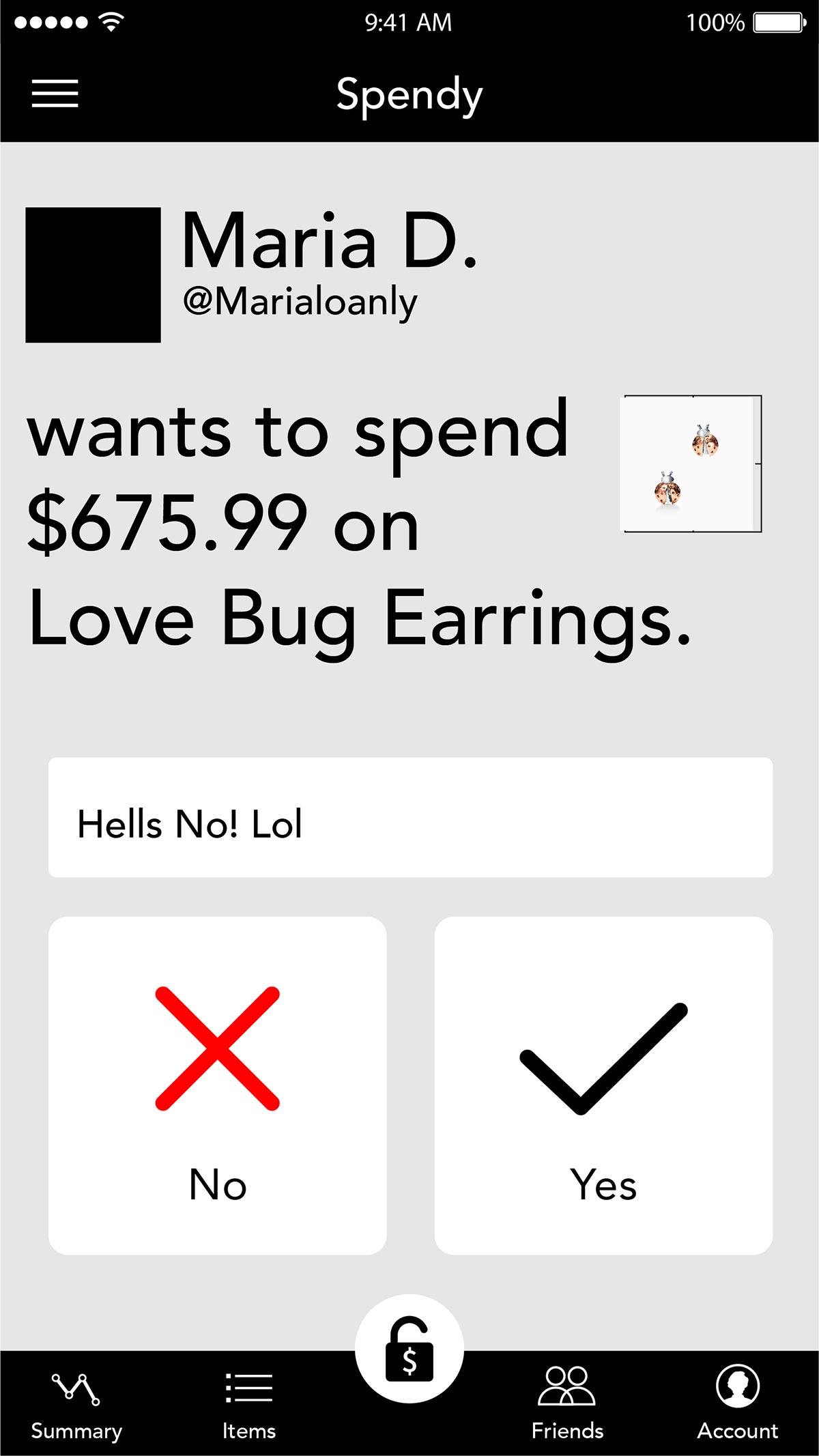

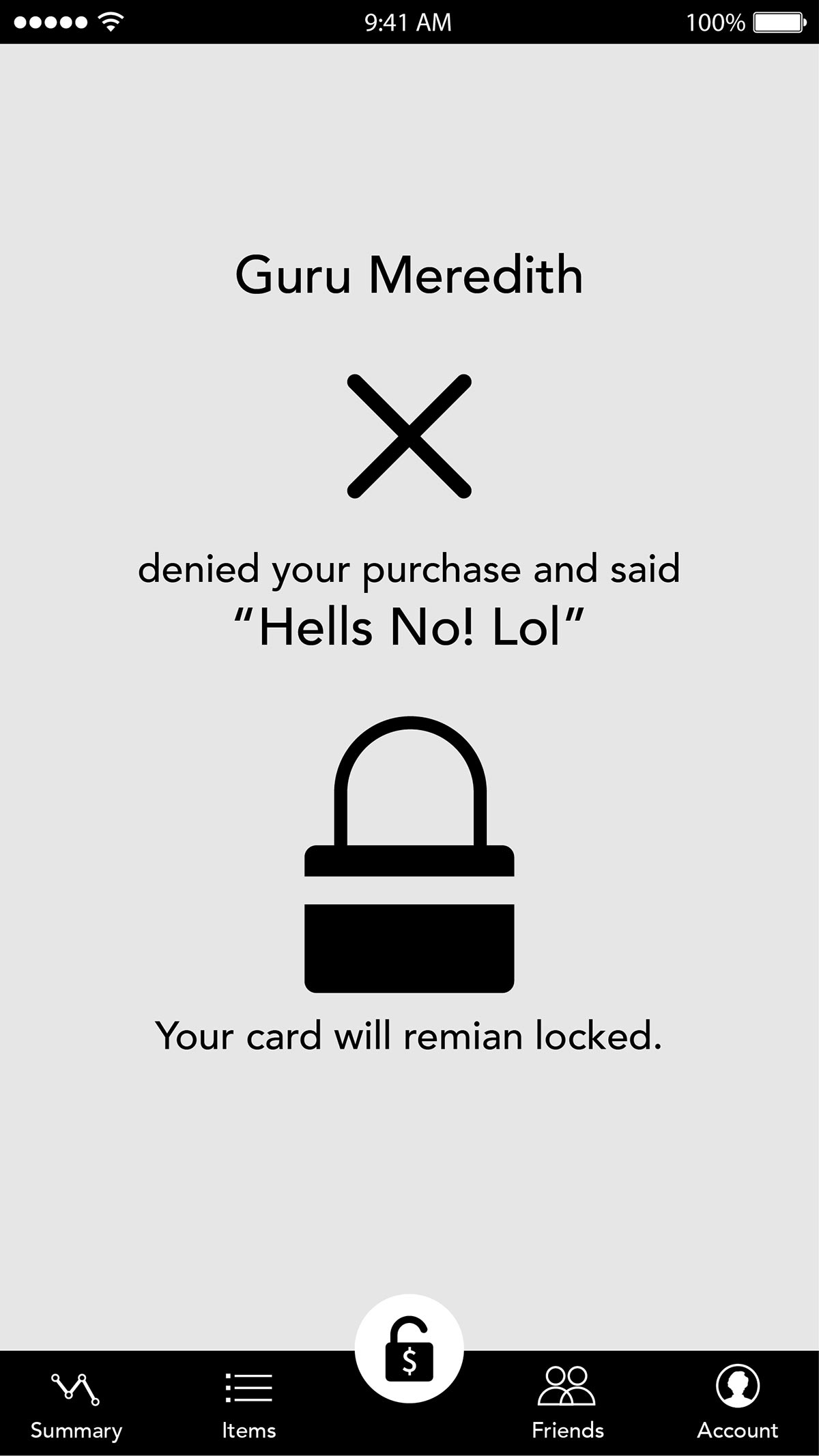

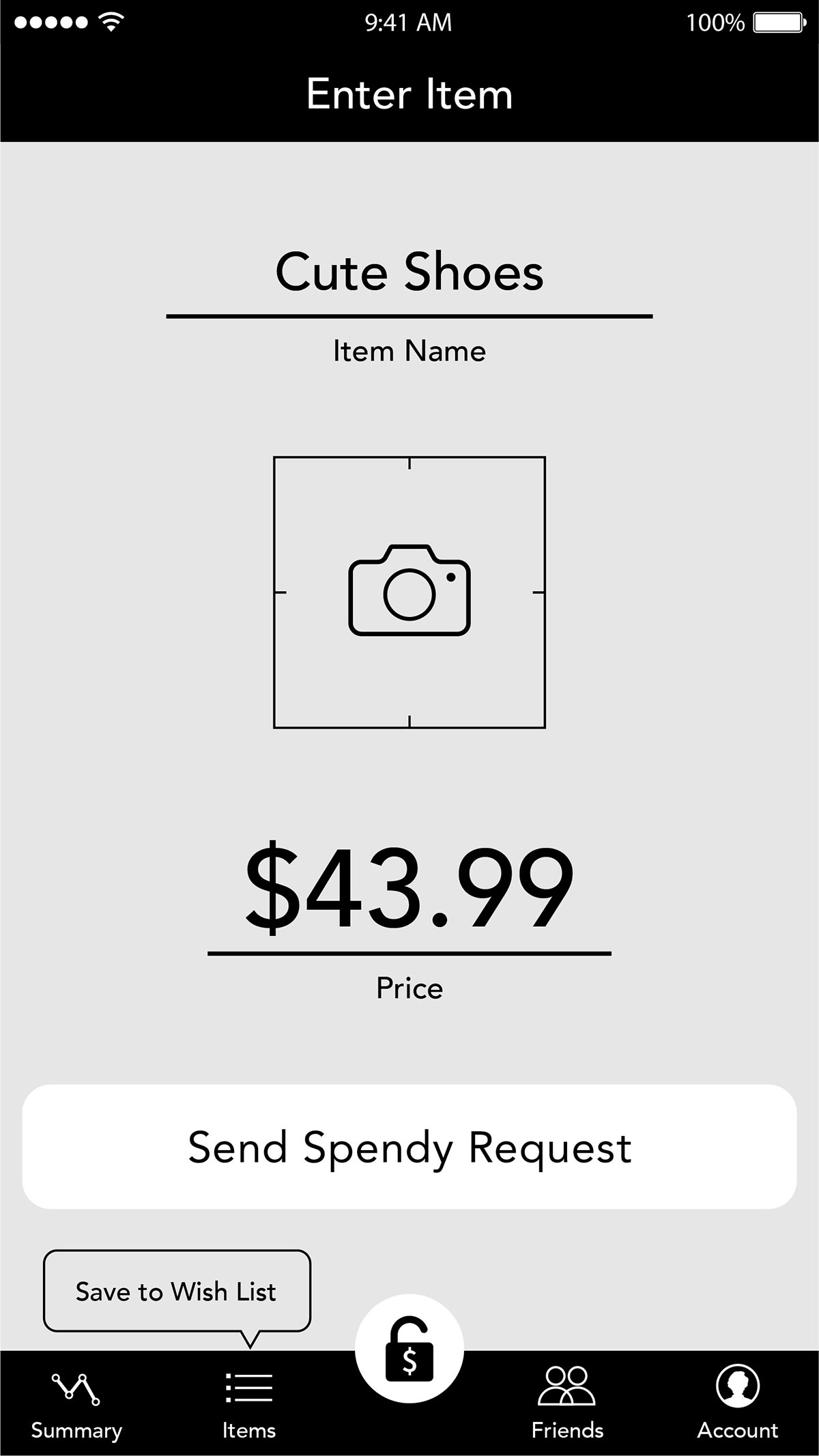

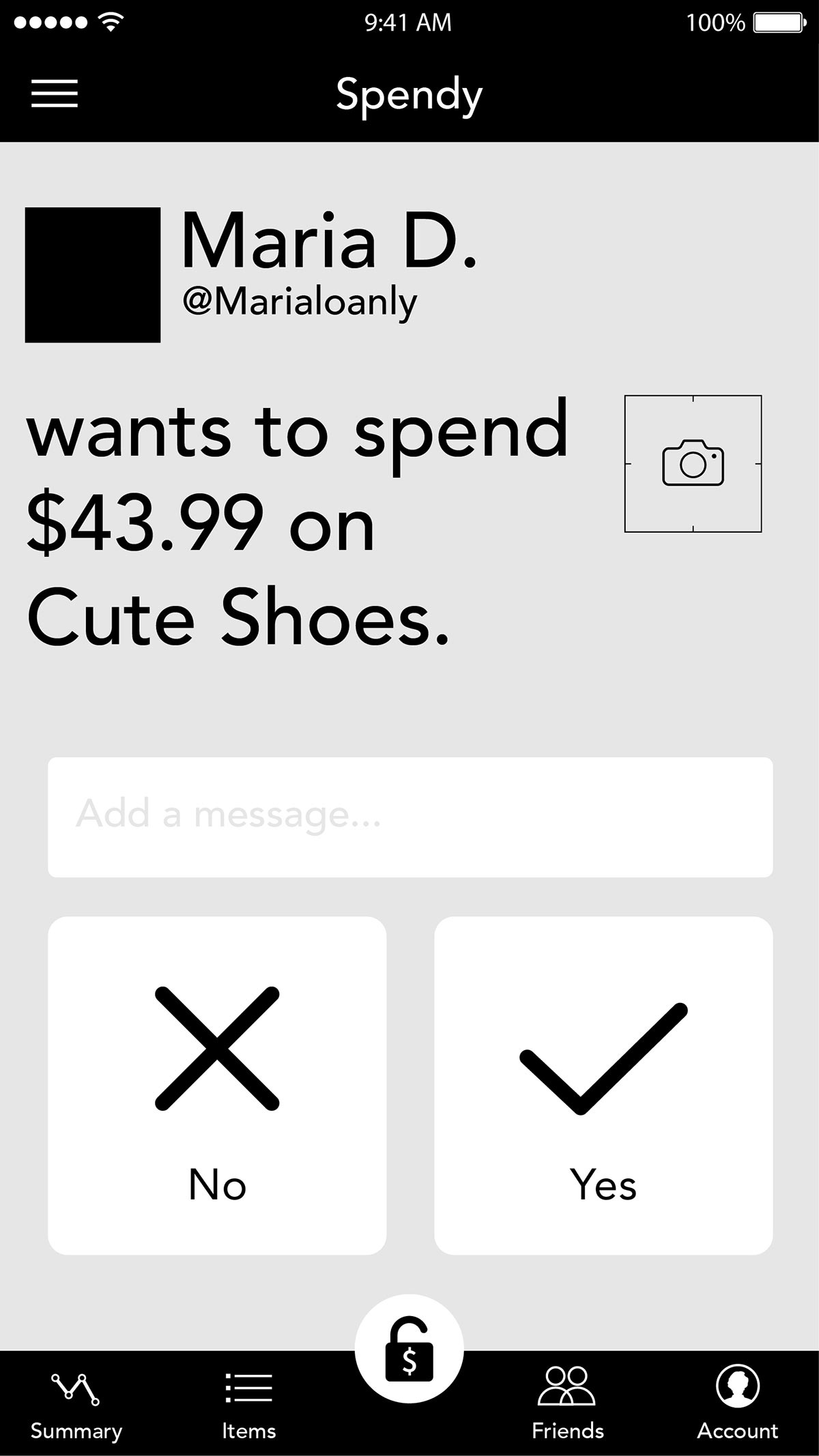

The Spendy application and phone case wallet helps to curb impulse purchases by requiring a trusted advisor to grant or deny access to your credit cards. The phone case locks credit cards inside the case and can only* be retrieved with the approval of a spending request by your spending guru.

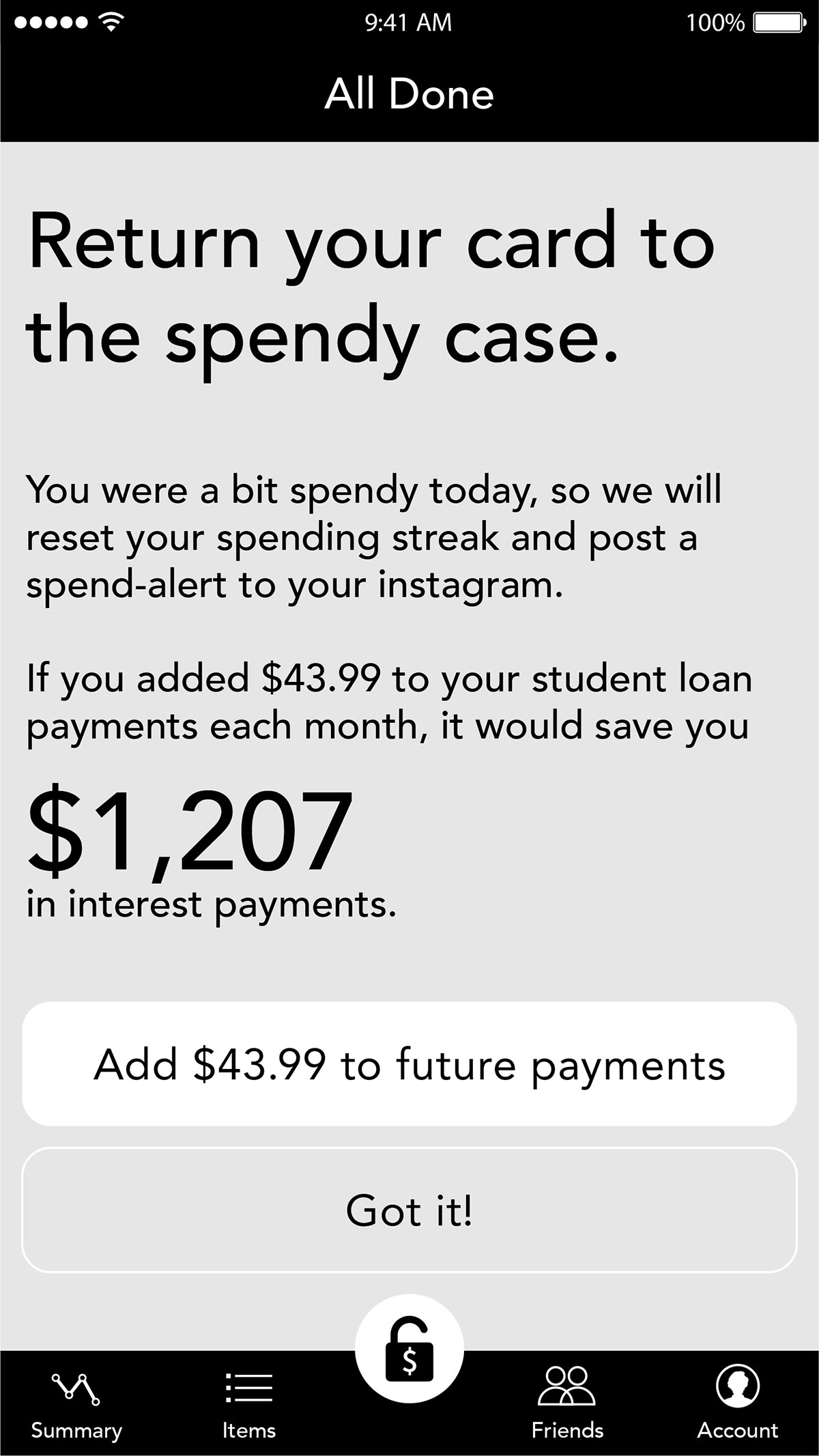

Application Wireframes

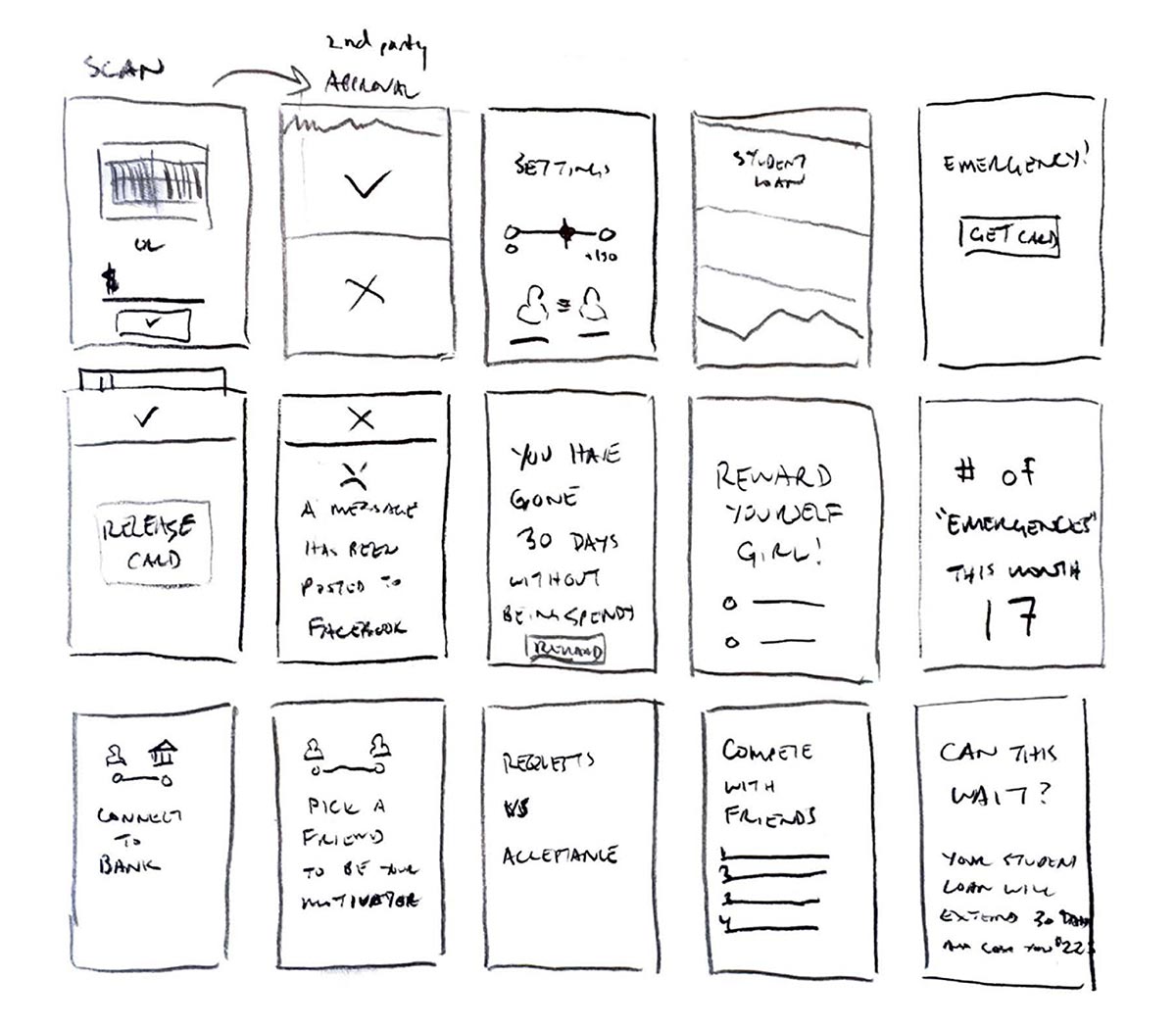

Starting with sketches for basic functionality, the application took form as a melding of software and hardware.

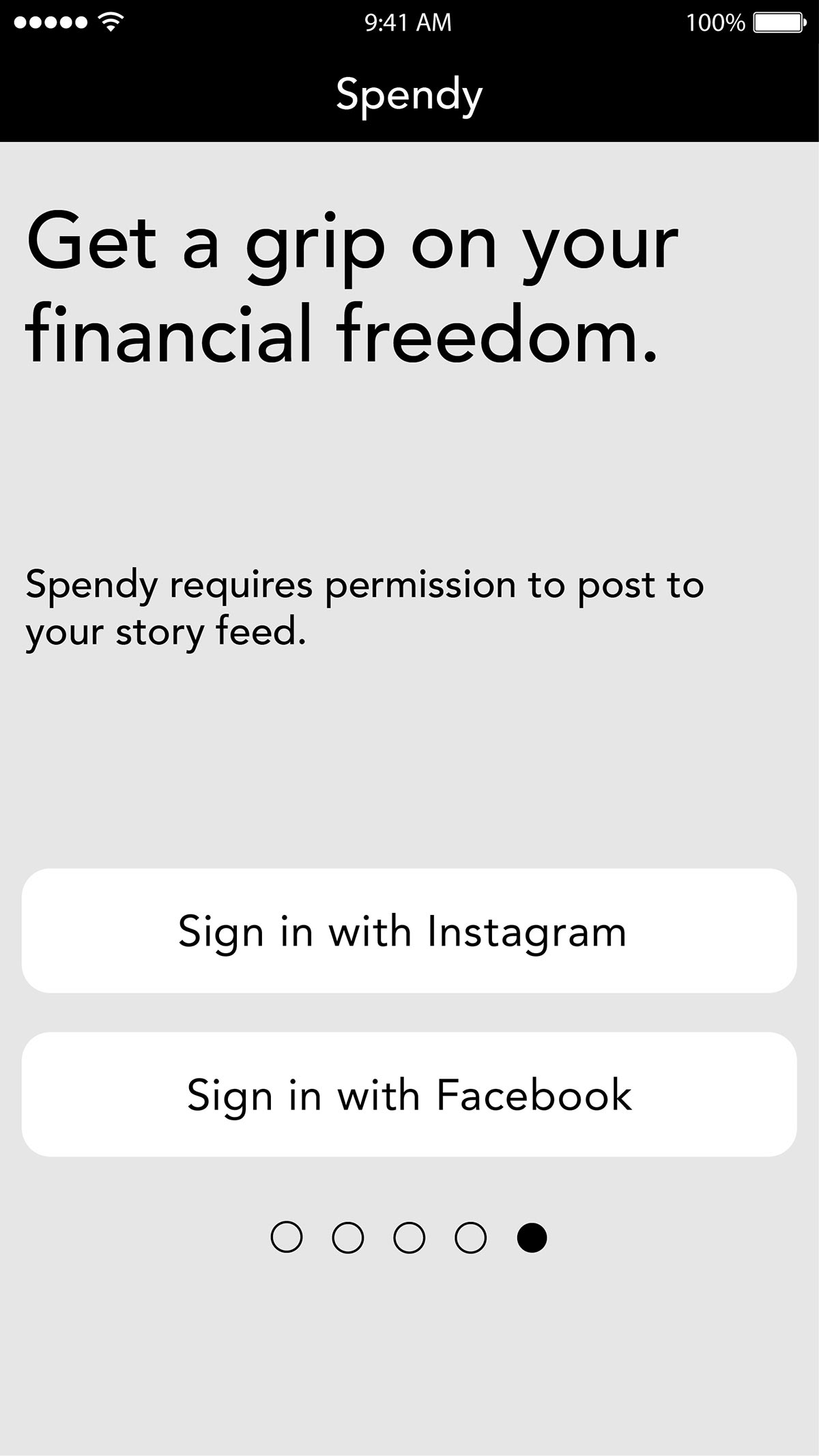

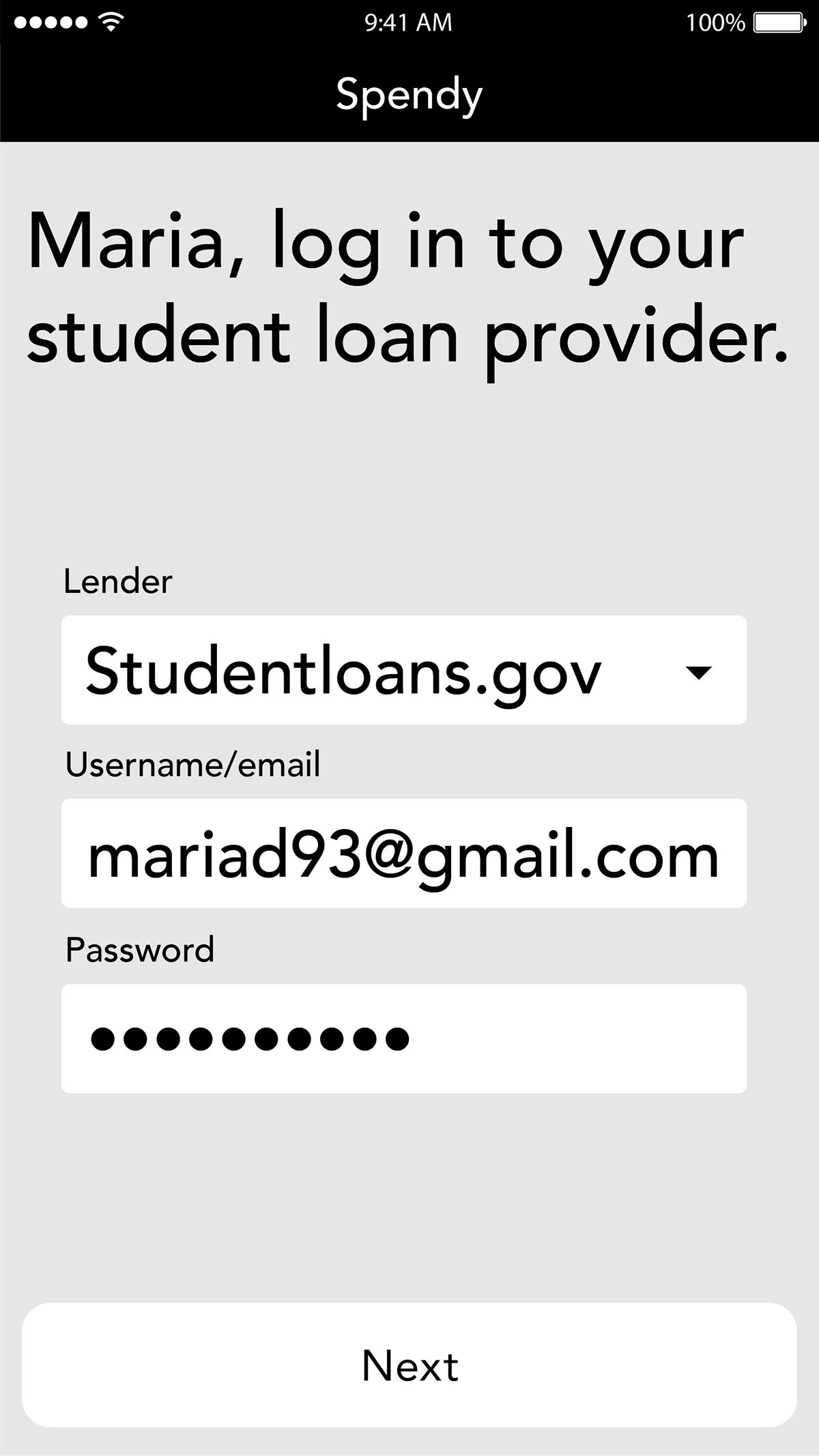

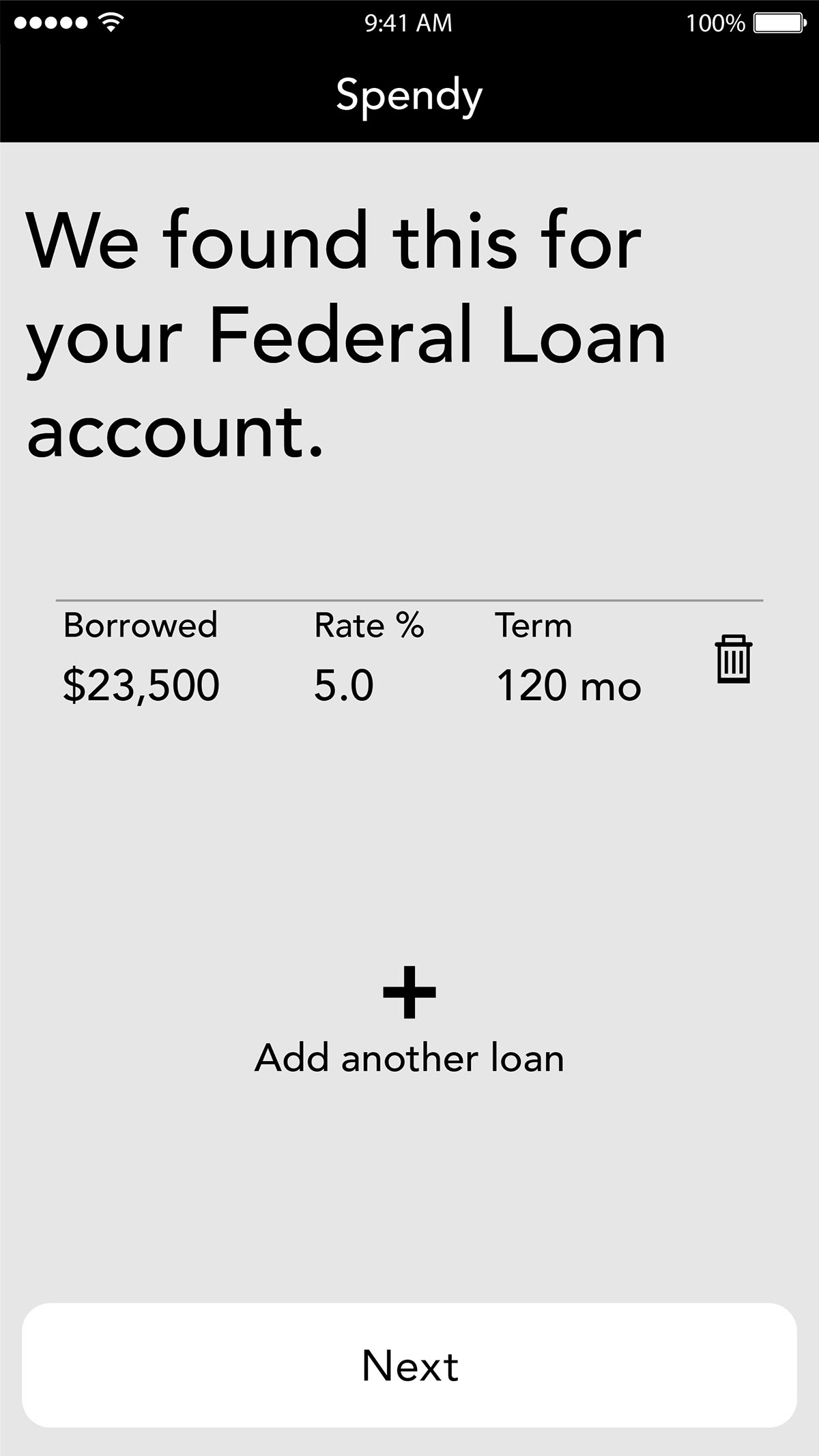

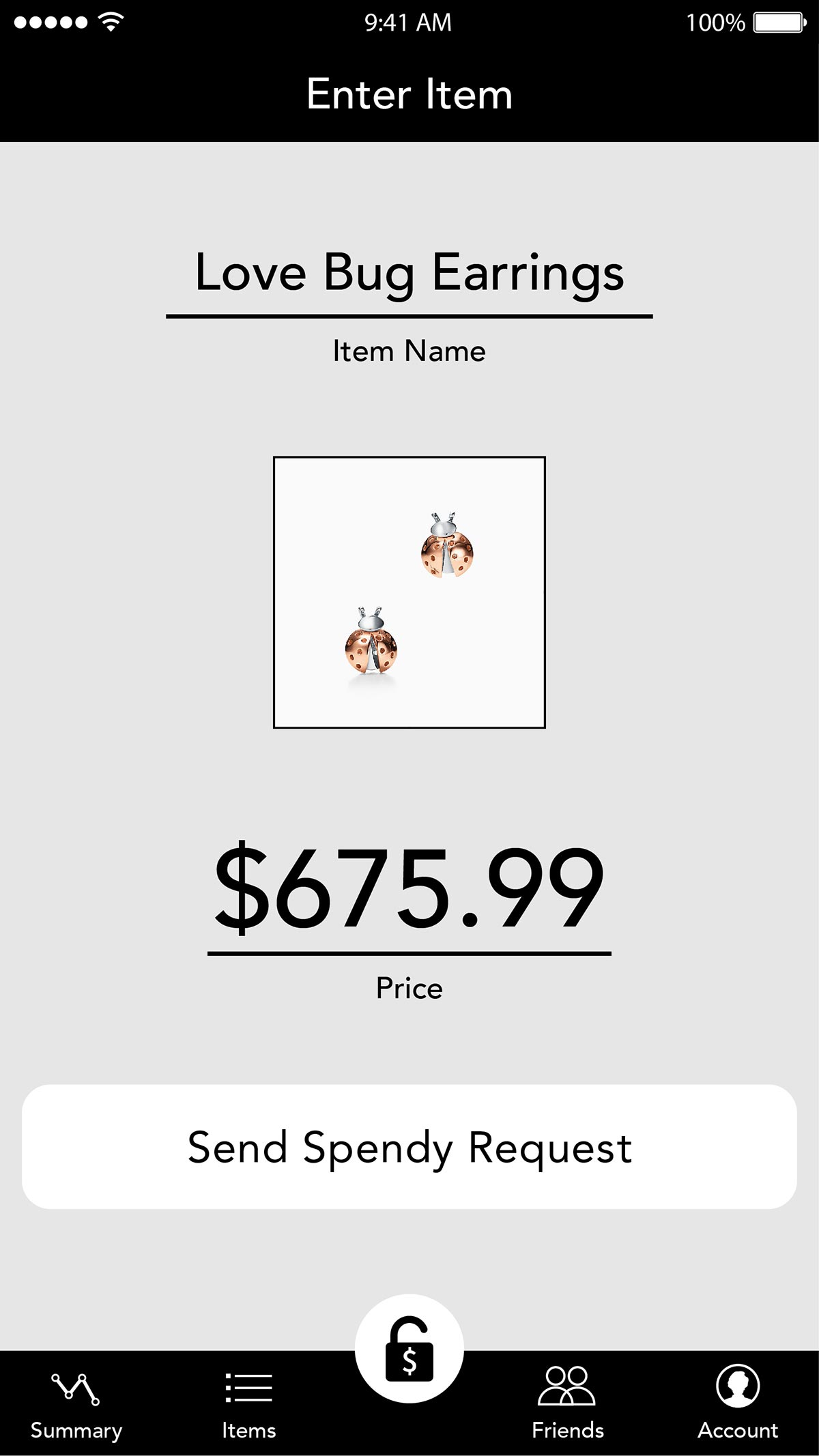

The final wireframes serve as an exploration of specific app functionality and cover many use cases such as initial sign up, connecting accounts, finding a guru, and requesting purchases.

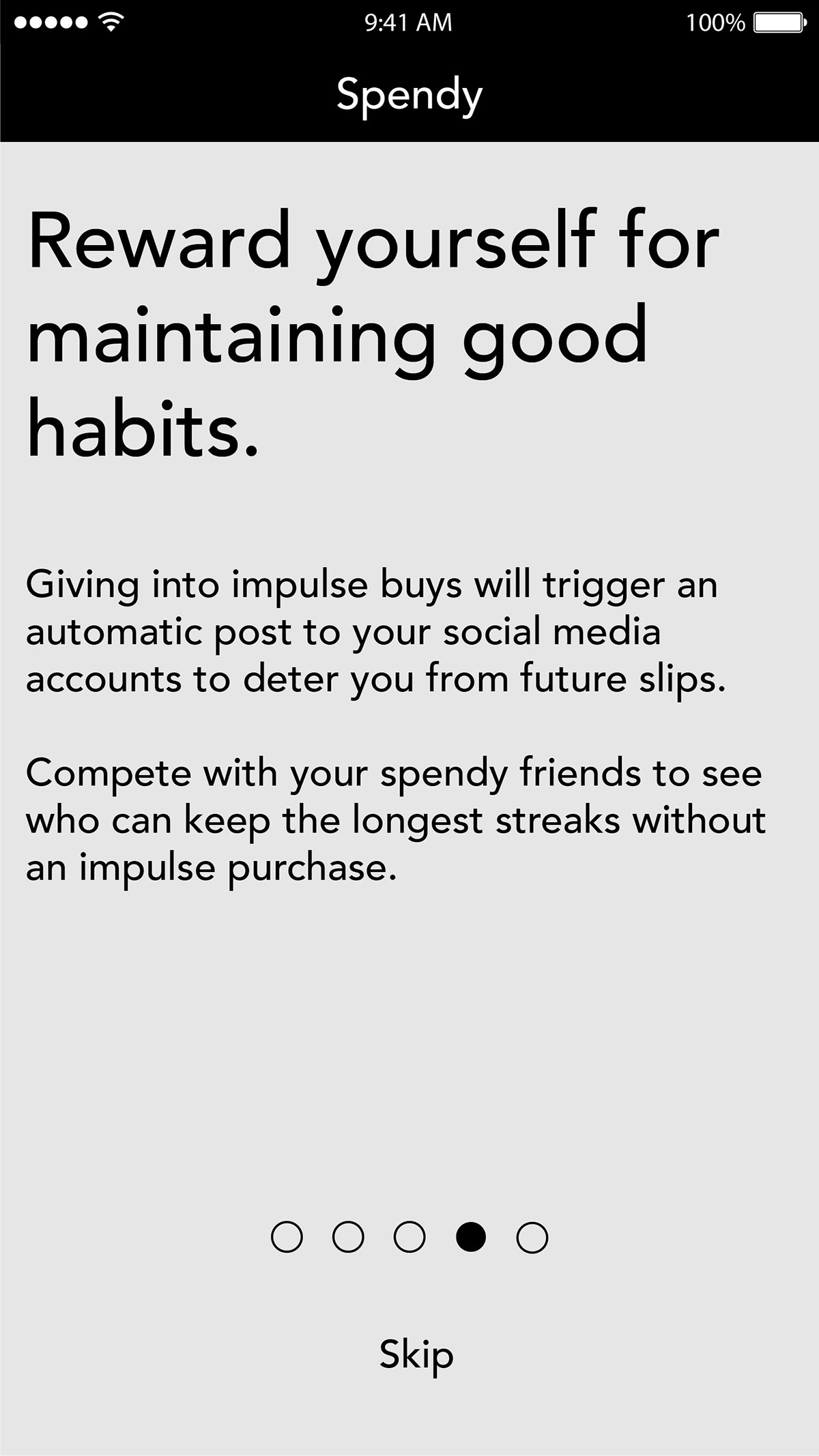

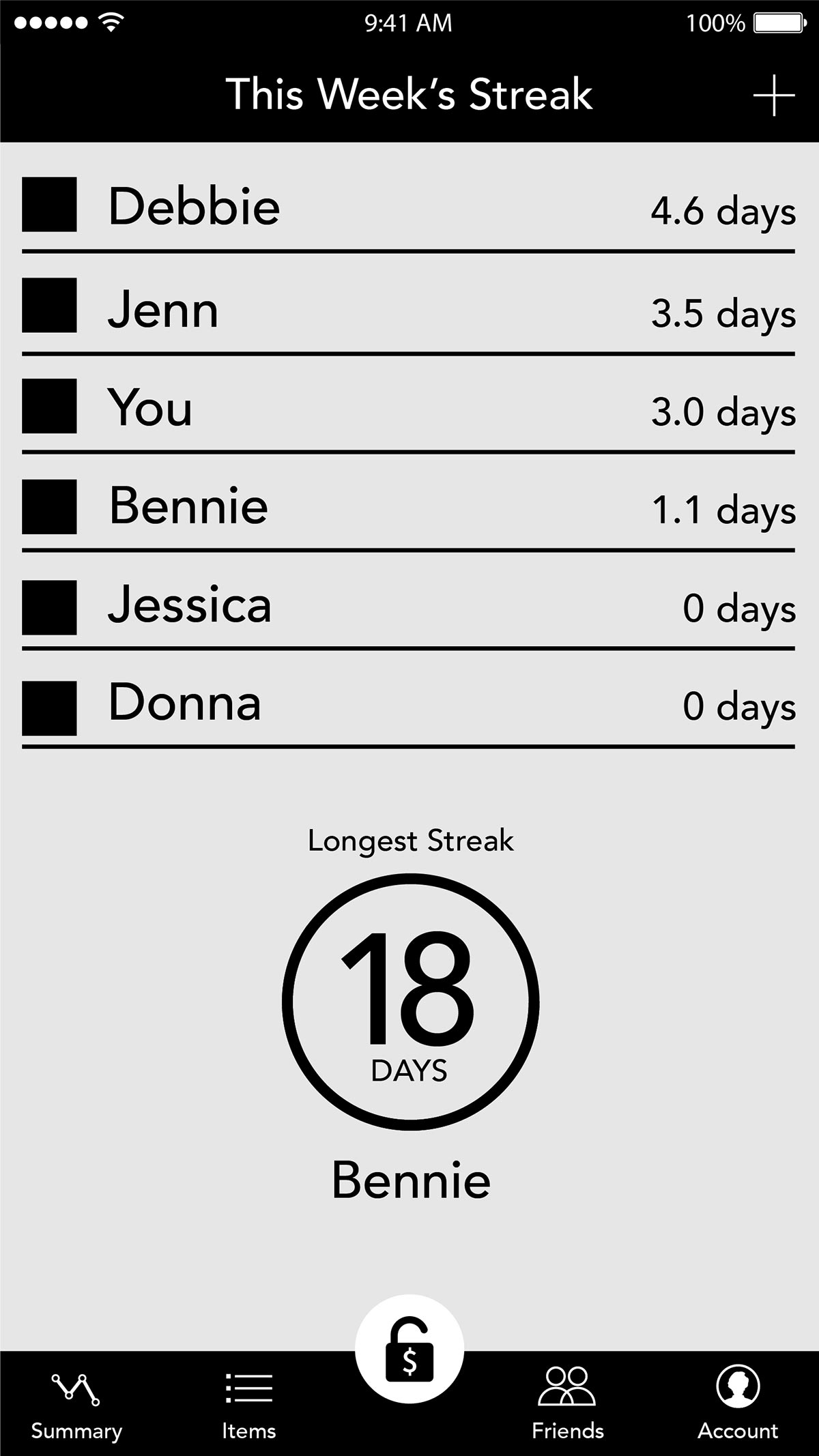

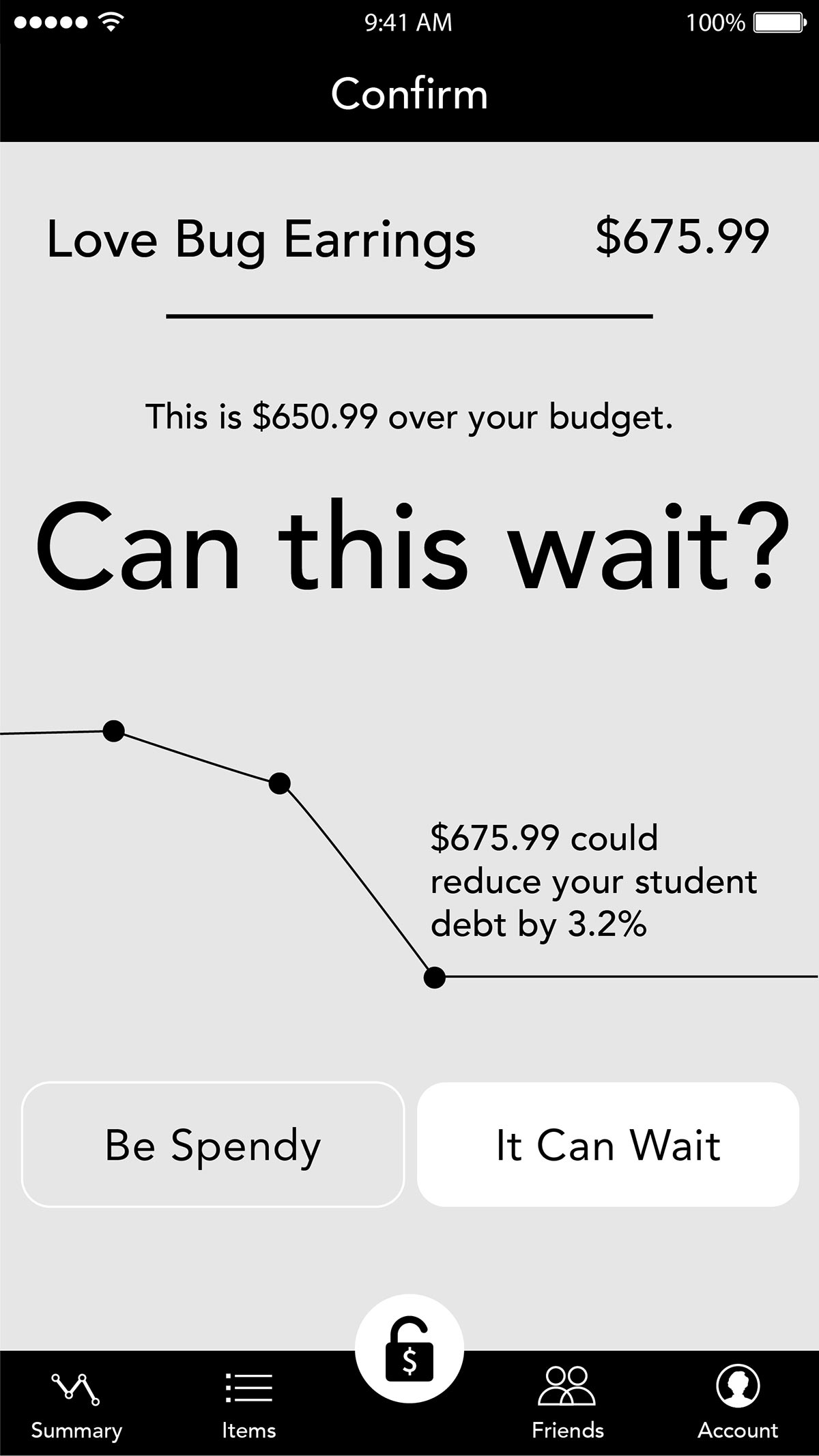

Other screens shown are how the application gamifies spendless sprees to have friends compete for the longest streak. The app will gently suggest that purchases could be saved for a later date and will suggest using the purchase price of items to instead be used to repay student debts.

The overall goal of the app is to help the user establish better financial habits and be mindful of how impulse spending harms their long term financial goals.

Case Prototype

The Spendy case prototype shows the main features of the wallet phone case. It has a carrying strap, card slots that are locked, as well as the connector to plug the phone into the case. The case would also have a battery, to keep the phone charged longer—further incentivising its use. The prototype is non-functional, but just aims to show the scale and provide the ability to do mock tests with the application.

The phone case wallet locks two credit/debit cards into the back of the phone and can only be accessed when the accompanying app grants permission. The case also will offer RIFD protection and can hold an ID card that can always be accessed. A wrist strap makes it easy to carry and less likely for the user to leave it somewhere by accident.

Video Prototype

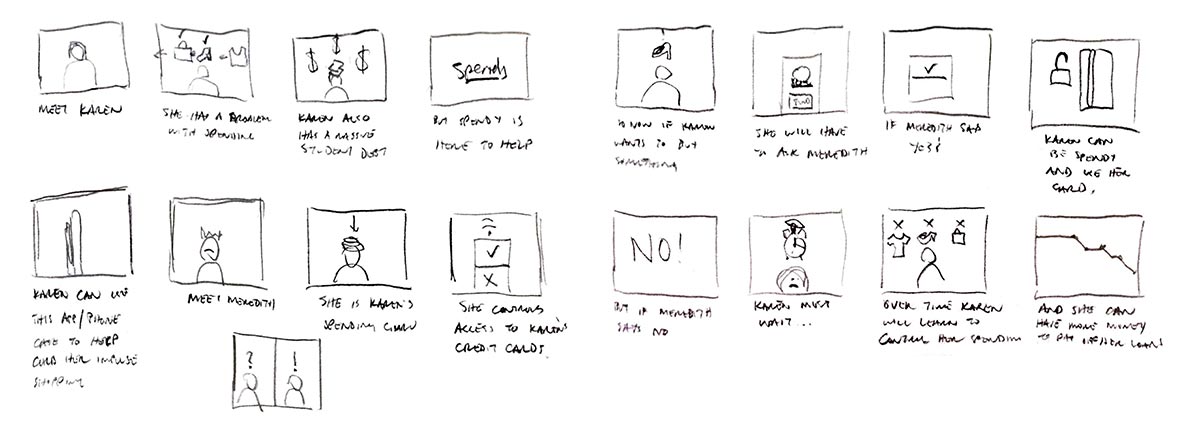

To help explain Spendy to users, a promotional video prototype was developed. The video explains the functionality of the phone case and how a friend can act as a trusted spending guru.

A quick storyboard helped to plan the animations in the video and develop a script.

The video prototype shows the most common uses for the Spendy app system with simple animations and characters to make the app more universally appealing.